Running a successful Ecommerce business in the UK and across Europe means more than having great products - it requires precise financial oversight and strict tax compliance. Shifting VAT regulations, complex logistics and multiple currencies mean solid accounting practices are no longer optional - they’re essential.

Our colleagues at Ecommerce Accountants have put together 8 accounting best practices for sellers operating across these markets.

Perhaps the most basic but often overlooked by new sellers is maintaining distinct bank accounts for your business. This simple practice streamlines your bookkeeping, supports VAT reclaim accuracy and provides far cleaner financial reporting - particularly important should you undergo any tax inspections.

This additional distinction between personal and business finances also helps sellers view and grow their business as a separate entity.

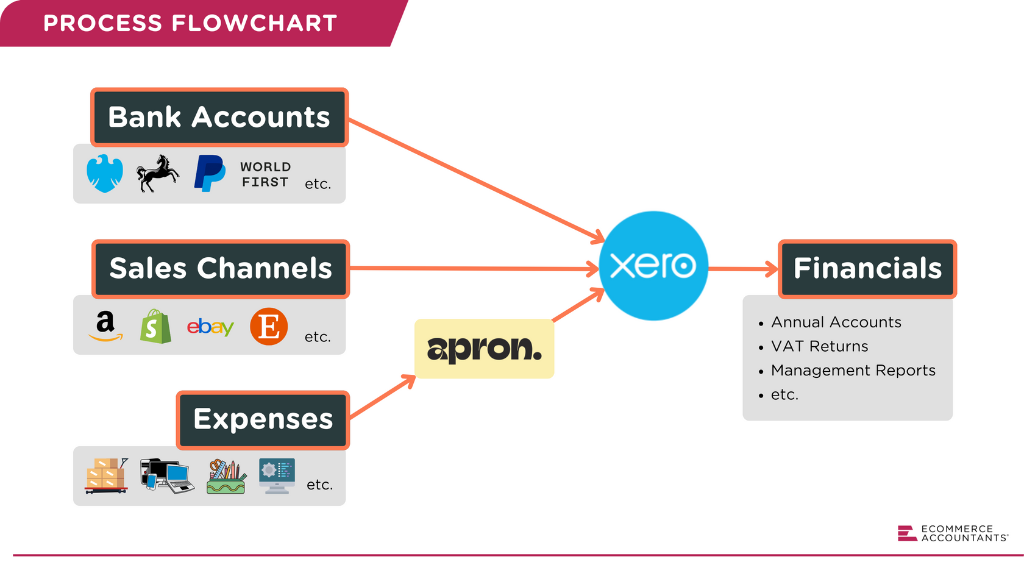

When it comes to your books, manual entry demands much of your time and often leads to errors. This is where accounting software proves invaluable. We recommend choosing a platform that integrates directly with your chosen sales channels (Shopify, Amazon, WooCommerce, etc.), provides VAT features and offers multi-currency support.

In the UK, we’d recommend Xero, which we use for all our clients, but there are alternatives like QuickBooks or FreeAgent. You can then use plugins such as Link My Books to automate reconciliation between your sales channels and accounting ledgers. At Ecommerce Accountants, we use our in-house tool Ecommerce Fusion, which is currently only available for our clients. Weekly or monthly reconciliations of your sales channels against your accounting software will further increase accuracy.

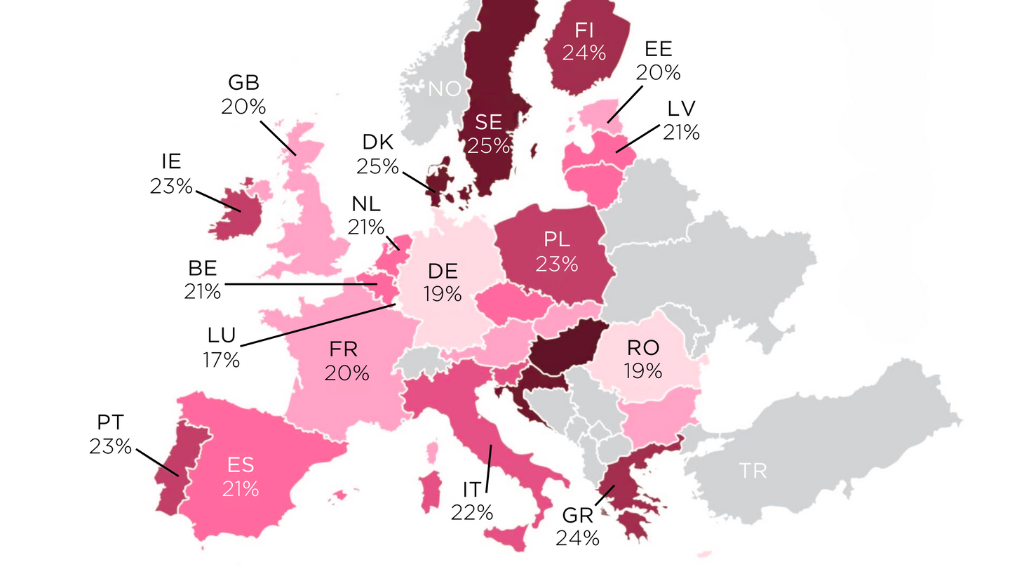

Selling across Europe has multiple VAT implications. You may consider the EU VAT One-Stop Shop (OSS) or Import One-Stop Shop (IOSS) schemes, aimed at simplifying EU VAT collection. Nonetheless, accurate country-by-country sales tracking is crucial to VAT compliance.

Worth noting is that, depending on the type of transaction and location of the customer, platforms like Amazon and eBay frequently collect and remit VAT on a seller’s behalf. That being said:

To avoid underreporting or duplication, always review the VAT reports provided by each of your marketplaces. A VAT-focused partner, such as SimplyVAT, can automate your filings while reducing the risk of these errors and related penalties.

Many sellers neglect COGS (Cost of Goods Sold) tracking, which inflates their profits and leads to surprising tax bills. Sellers should use systems which sync stock levels with order data, thereby accurately keeping track of profit margins. This becomes even more important when importing goods from non-EU suppliers because landed costs and customs VAT also need to be accounted for.

If you’re selling in an array of currencies (euros, dollars, pounds), ensure that your accounting software:

Where applicable, use multi-currency accounts such as WordFirst, OFX or Wise. This will allow your business to accrue and hold various currencies without converting them. Using this type of account, you can:

Both the UK and the EU now have digital recordkeeping requirements. This is the Making Tax Digital (MTD) scheme in the UK and SAF-T reporting in the EU. To keep your business compliant, you should:

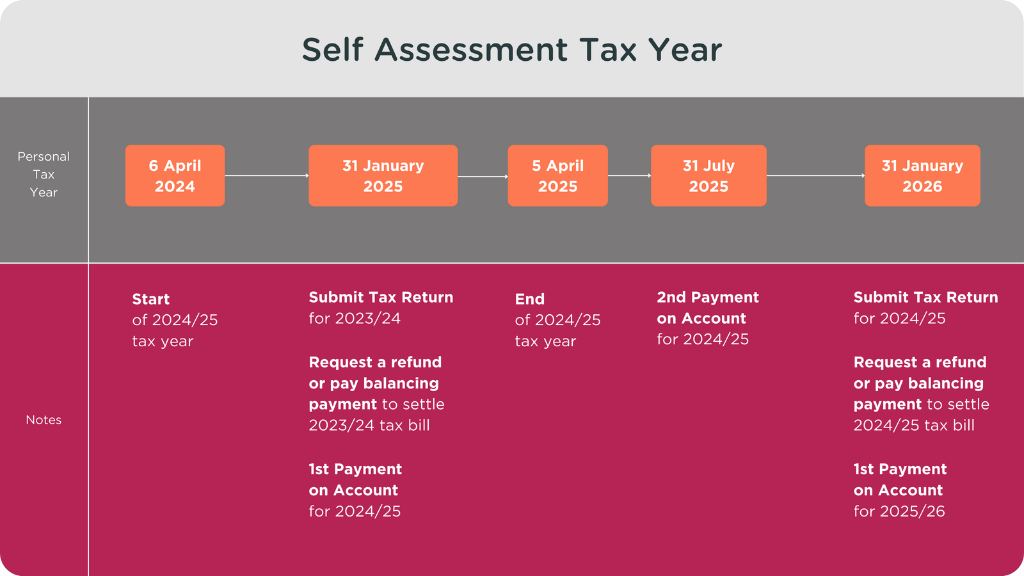

Business owners have to juggle a mix of business and personal deadlines. To reduce stress, it’s critical to calendar and set alerts for these.

When it comes to VAT, incorrect returns or late filings may lead to fines for both UK and EU sellers. In the EU, pay careful attention to local filing frequencies as these vary from monthly to quarterly based on the specific country and your turnover. To avoid expensive oversights, you should set up alerts or utilise a VAT compliance service.

If you run a company (corporation), you need to stay abreast of the company’s reporting deadlines. For a limited company in the UK, these would include the annual due dates for submitting your statutory accounts (9 months after year-end), company tax return (12 months after year-end), confirmation statement, and Real-Time Information (RTI) submission. You should diarize all of those applicable.

As a director or sole trader (sole proprietor), you also need to note personal tax deadlines. In the UK, this would be the annual due date for your Self Assessment tax return (31 January) as well as your 2 payments on account (31 January and 31 July), as shown in the image above.

As a business owner, time is your most valuable asset. While these best practices are essential, they do require a lot of your time. This is where an accountant can help.

That said, ecom business models and platforms are riddled with nuances that run-of-the-mill accountants struggle to grasp. Fortunately, there are accountancies, such as Ecommerce Accountants, who were established to address that very problem. There are many reasons you should consider an ecommerce accountant. This will allow you to:

Looking for help with your business’s accounting practices? Our friends at Ecommerce Accountants focus specifically on serving sellers and businesses across all ecommerce platforms and models.

Get in touch with Ecommerce Accountants today.

Good accounting is about more than compliance - it’s about strategy. Whether you're scaling a Shopify store in the UK or fulfilling Amazon orders across Europe, solid accounting practices will protect your profits, keep you compliant and reduce stress.