The reverse charge mechanism is an EU VAT rule that makes reporting VAT on some transactions a little simpler. It was originally introduced to help prevent VAT fraud. You’re most likely to encounter the reverse charge mechanism if your business is B2B.

The most common transactions that the reverse charge mechanism applies to are:

You might also see it called “self-accounting”, which tends to be the way reverse charge is described by the buyer in a transaction.

Usually, when a VAT-registered business sells something to a customer, it charges that customer VAT. They then report the amount of VAT they collected and pay it to their local tax authority. Reverse charge works by switching the responsibility for reporting and paying the VAT to the customer. Rather than paying the seller the VAT, the buyer reports it on their VAT return.

That’s why reverse charge only applies to B2B transactions, as the buyer has to be VAT-registered. It’s also easy to see why it’s sometimes called “self-accounting” as the buyer accounts for the VAT themselves.

For the reverse charge mechanism to work, both the seller and the buyer have certain things they have to do.

When using the reverse charge mechanism, sellers aren’t responsible for the VAT, but they do have to do three very important things:

It’s so important to check that your buyer is actually VAT registered. If they’re not, you’ll be liable for the VAT. In addition, incorrectly issued invoices are a common problem that costs businesses a lot of money. Make sure you get the wording on the invoice correct, or the responsibility for the VAT might shift back to you.

Finally, if you're in the EU or Northern Ireland, you’ll need to complete an EC Sales List, detailing which EU B2B customers the Reverse Charge was applied to.

The first thing you should do as the buyer is check that the invoice is correct. It needs to indicate somewhere that the reverse charge applies.

When you next file a VAT return, you report both the supplier’s sale (the output VAT) and your purchase (input VAT). You can reclaim the VAT at the same time, meaning the money never leaves your pocket.

Finally, make sure you hold onto the invoice!

Depending on what you’re selling and who and where your customers are, you might need to register for VAT in the EU. You can only use reverse charge if:

Certain goods (like excise goods) or services (like event admission) have different place of supply rules, so reverse charge doesn’t apply.

The reverse charge mechanism helps tax authorities prevent fraud and benefits businesses that use it:

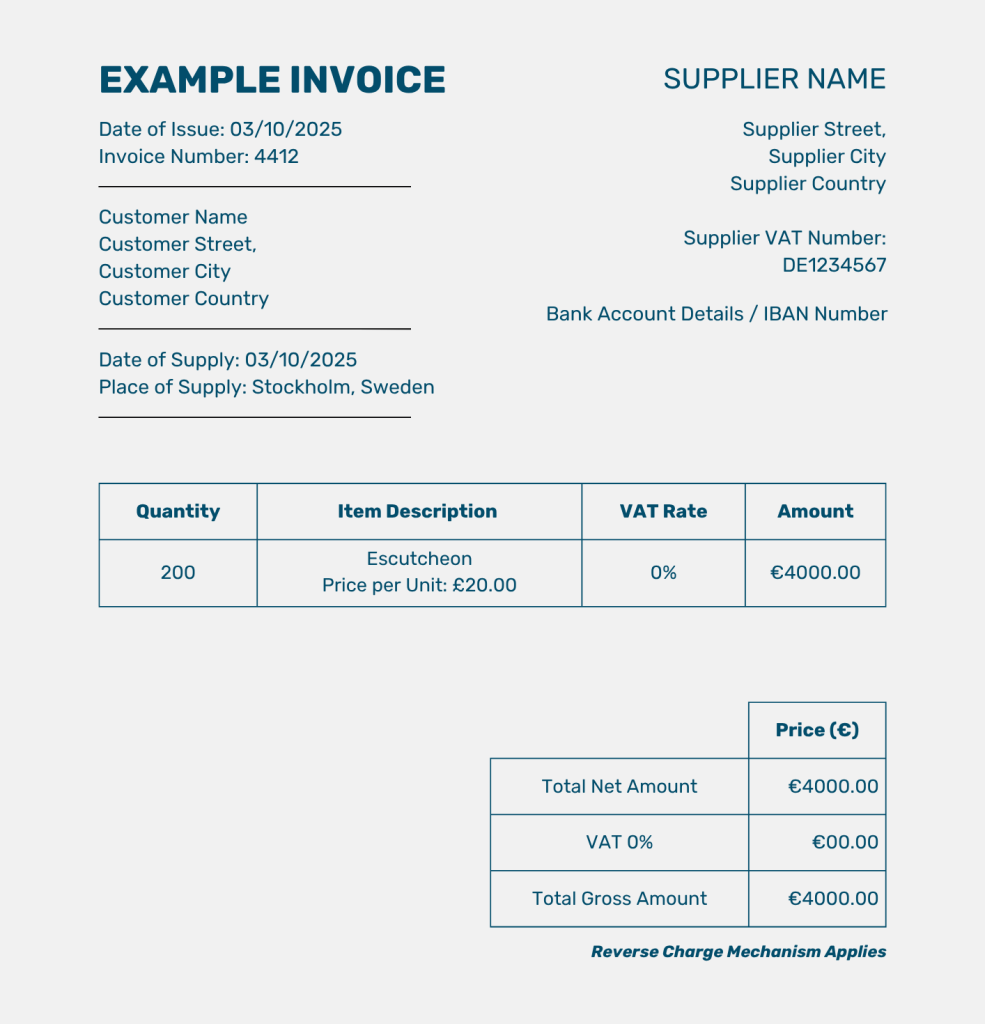

Company A is based in Germany. They make door furniture, which they sell to Company B in Sweden. Company A checks whether Company B’s VAT number is valid on VIES. They then produce an invoice with no VAT that includes the words “reverse charge mechanism”.

Company B calculates the right amount of VAT they would have paid and reports the sale on their next VAT return. At the same time, they report the transaction as a purchase and reclaim the VAT, meaning no money leaves their account.